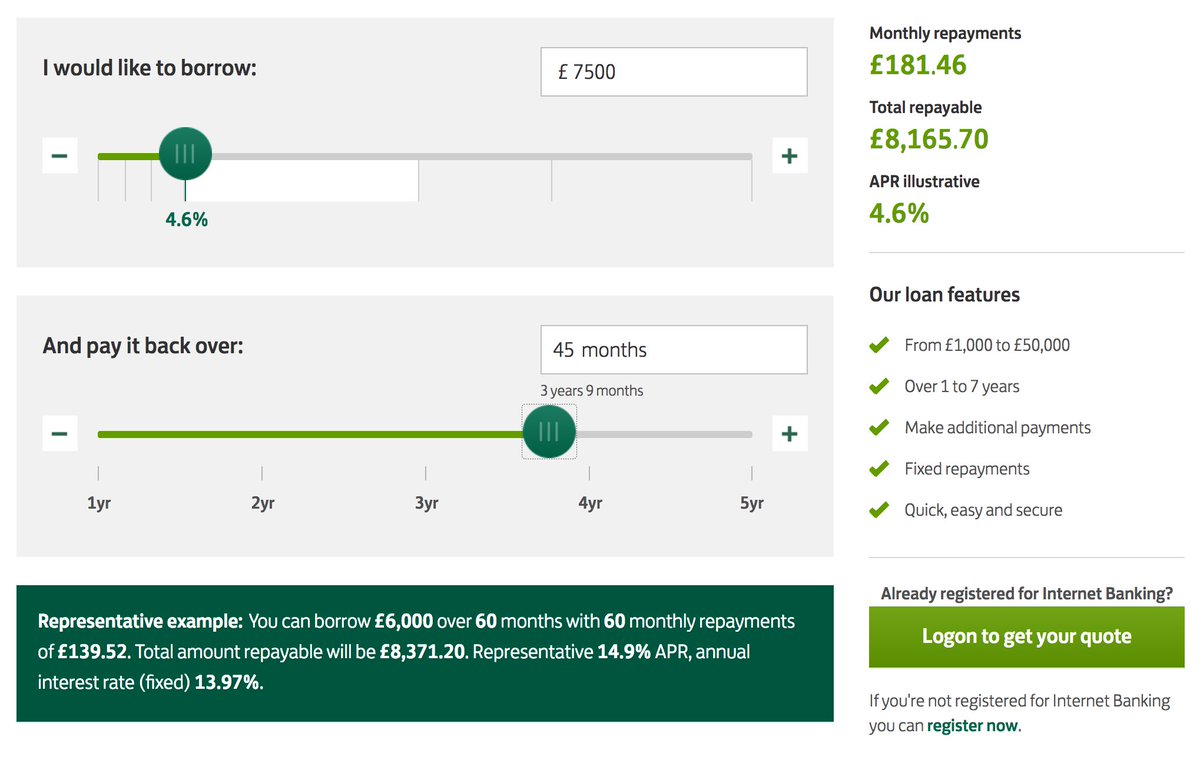

You can repay your quick loan between 1 and 7 years. They have concluded that a credit score is not a determining factor when it comes to discerning if one can repay their quick loan.

Their services are uniquely advanced and also extremely affordable. These services range from student loans for recent graduates to quick loans, as well as loans for those who don’t have good credit. Lloyds Bank provides an extensive range of services within the UK.

#LLOYDS LOAN CALC FULL#

To obtain a full list of the services they offer with detailed explanations of each one, you can visit their site, call them or visit a branch. Most financial lenders base their lending criteria around their potential client’s credit scores. Not only will they strive towards assisting such clients, but they will do so while maintaining their reputation of being trustworthy and responsible. They are well aware that people who seek quick loans in the UK will be in dire need of them. Lloyds Bank believes in helping those regardless of their financial status.

Hence, they provide simplified quick loans online and aim to educate their clients while assisting them in the fastest way possible. Lloyds Bank is very understanding of its clientele and their emergency financial needs. There will be times when you will find yourself in a position where you encounter unexpected expenses. Looking for the best Lloyds mortgage deal for you? Get in touch with our mortgage advice team on 01 or fill out the call back request form on the right hand side of the page for a swift response.Should you find yourself in search of a financial service provider that will not only provide access to the best quick loans in the country, but also the best rates for your pocket, then Lloyds Bank fits the criteria. Remortgaging with Lloyds – Whether you are a current Lloyds mortgage customer or have a mortgage from a different lender, you can potentially save money on your monthly repayments by remortgaging to Lloyds.īorrowing more on your mortgage with Lloyds – Lloyds customers who have had a mortgage with the bank for at least 6 months may be eligible to increase their borrowing with a separate secured homeowner loan. Lloyds buy to let mortgages – If you are at least 25 years old, already own a property and meet Lloyds’ other conditions, you can borrow up to 2 million across up to 3 buy to let properties. Lloyds moving home mortgages – Whether you are an existing Lloyds customer looking to take your mortgage with you when you move, or are a new or existing customer looking for a new mortgage on a new property, Lloyds have a variety of deals available. Lloyds first time buyer mortgages – With a Lloyds first time buyer mortgage, you can purchase a first home with a deposit of as little as 5%. Lloyds offers a number of different types of standard mortgages designed to match the different borrowing needs of different types of customers.

#LLOYDS LOAN CALC FREE#

To investigate your mortgage options, try our free mortgage calculator or get in touch with our experienced mortgage brokers by calling 01 or filling in the call back form on the right.

Market-leading mortgage rates – see all the top mortgage deals currently available.Whole of market access – we have links with all the top mortgage lenders.Our team of highly experienced mortgage brokers work with Lloyds and all the leading lenders to offer you: This then gives you a clear choice for which mortgages offer the best deal for you. Using this information, the mortgage calculator will then show you the top matching deals from Lloyds and all the other leading lenders. Whether you want to repay the capital and interest or have an interest only mortgage.Which type of mortgage you are looking for.You can then select a number of key factors including: Our free mortgage calculator offers a straightforward way to compare mortgage deals from Lloyds and all the leading mortgage providers across the market.Īll you need to do is head to the top of the page and choose the type of mortgage deal you are looking for, including first time buyer mortgages, remortgaging and buy to let mortgages. Lloyds Mortgage Calculator Try our free Lloyds mortgage calculator

0 kommentar(er)

0 kommentar(er)